Goulston & Storrs M&A attorney Dan Avery is a nationally recognized expert on M&A deal point trends. In partnership with Bloomberg Law, Dan has developed a series of 25 articles looking at these trends, on a topic-by-topic basis, providing practical insight into where these trends are heading, and the relevant implications for M&A deal professionals

Market Trends: What You Need to Know

As shown in the American Bar Association's Private Target Mergers and Acquisitions Deal Points Studies:

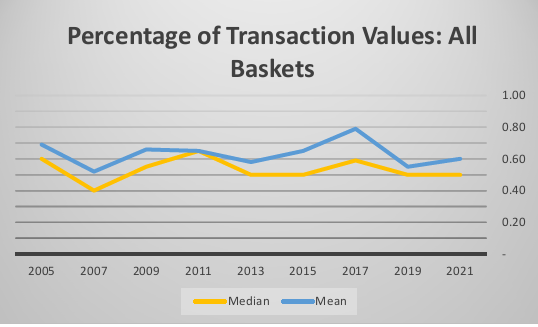

- Over the time period covered by the nine studies (2005-2021), the level of indemnity baskets as a percentage of transaction value, whether as mean or median, has remained fairly consistent.

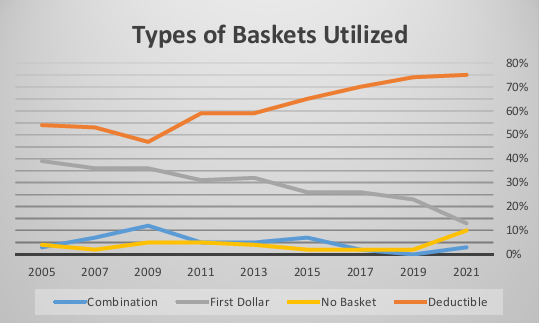

- In terms of the specific types of baskets, deductibles have become increasingly common, now seen in almost ¾ of transactions reviewed in the 2021 study.

- The 2017, 2019, and 2021 ABA studies each show that indemnity caps were lower in reported deals where RWI was referenced in the deal documents, as compared with transactions without any such reference.

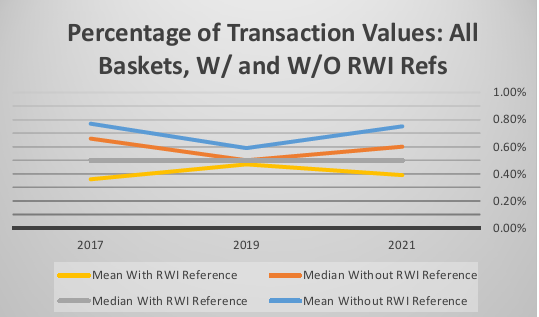

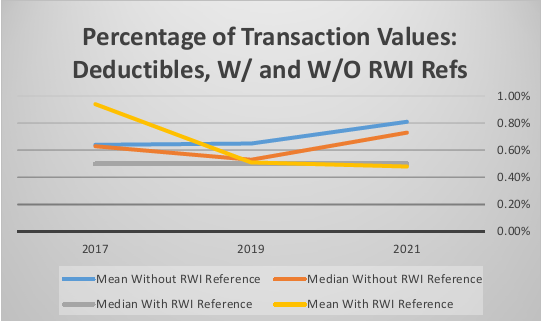

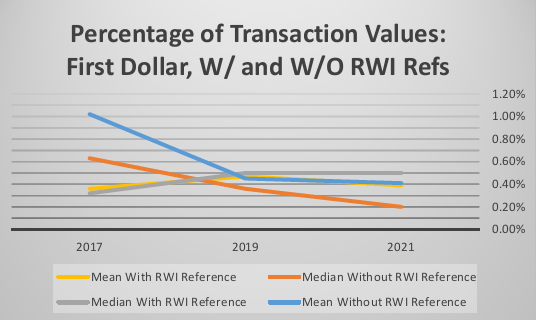

- The linkage of indemnity baskets to RWI references seems consistent (i.e., baskets tend to be lower when RWI is present), though perhaps more tenuous than the connection between RWI and indemnity caps.

Introduction

In merger and acquisition (M&A) transactions, the definitive purchase agreement, whether asset purchase agreement, stock purchase agreement, or merger agreement, typically contains representations and warranties made by the seller with respect to the target company. Representations and warranties not only provide information to the buyer, but also operate to allocate risk as between the buyer and seller with respect to the matters covered by the representations and warranties.

In addition to representations and warranties, M&A purchase agreements generally include indemnification provisions, pursuant to which any given party (indemnitor) agrees to defend, hold harmless, and indemnify the other party or parties (indemnitees) from specified claims or damages. These typically include claims arising from a breach of the indemnitor's representations and warranties or covenants set forth in the purchase agreement, or with respect to other specific matters.

These indemnity obligations are generally subject to various limitations, including with respect to the time limit during which the indemnity is applicable, including the amount of damages required to be suffered before the indemnity obligation is triggered.

This article examines how buyers and sellers are negotiating indemnity baskets in private company M&A transactions, as shown in the American Bar Association's private target deal points studies.

Indemnification Provisions

A typical indemnification provision in an M&A purchase agreement may read as follows:

Indemnification by the Seller. The Seller agrees to and will defend and indemnify the Buyer Parties and save and hold each of them harmless against, and pay on behalf of or reimburse such Buyer Parties for, any Losses which any such Buyer Party may suffer, sustain or become subject to, as a result of, in connection with, relating or incidental to or arising from:

(i) any breach by the Seller of any representation or warranty made by the Seller in this Agreement or any Additional Closing Document;

(ii) any breach of any covenant or agreement by the Seller under this Agreement or any Additional Closing Document;

(iii) any of the matters set forth on Schedule [___];

(iv) any Taxes due or payable by the Company or its Affiliates with respect to any Pre-Closing Tax Periods; or

(v) any Company Indebtedness or Company Expenses to the extent not repaid or paid, respectively, pursuant to Section [___] and not included in the purchase price adjustment pursuant to Section [___].

Types of Baskets: The Deductible and the Tipping Basket

The representations and warranties of the target company, or selling stockholder(s), as applicable, are likely to be much more extensive than the typically limited representations and warranties of the buyer. Accordingly, the buyer is more likely than the seller to be the indemnitee and beneficiary of indemnity, and thus has an interest in keeping any limitations on indemnity to a minimum. The seller or indemnitor, of course, has the opposite interest: to limit the circumstances in which it will have indemnity liability to the buyer or any other indemnitee.

Indemnity baskets provide that until otherwise indemnified damages reach a specified level, those damages will not be eligible for indemnification; instead, those damages sit within a basket of damages borne by the buyer, assuming the seller is the indemnitor.

There are two main types of indemnity baskets. The first is a deductible basket, where any amount of losses up to a certain dollar amount fall within the basket and are never subject to indemnification, similar in application to the well-known consumer insurance deductible. The second is referred to as a “tipping,” “first dollar,” or “dollar one” basket. With this second type of basket, the indemnification coverage kicks in only once the specified level of damages is reached and exceeded; and for this “tipping” basket, the indemnification coverage kicks in for the entire amount of damages, not just the damages above the specified amount. A first dollar basket is, in effect, a deductible basket which disappears when the deductible level is exceeded.

A deductible basket may be described in an M&A purchase agreement as follows:

“(A) Notwithstanding the foregoing, the Seller will not have any liability under clause (i) above: unless the aggregate of all Losses relating thereto for which the Seller would, but for this clause (A), be liable exceeds on a cumulative basis an amount equal to $X (the “Basket”), whereupon the Seller shall be liable for all such Losses in excess of such Basket amount, subject to the other limitations herein.”

As a tipping or first dollar basket, that provision could be worded as follows:

“(A) Notwithstanding the foregoing, the Seller will not have any liability under clause (i) above: unless the aggregate of all Losses relating thereto for which the Seller would, but for this clause (A), be liable exceeds on a cumulative basis an amount equal to $X (the “Basket”), whereupon the Seller shall be liable for all such Losses, including those within such Basket amount, subject to the other limitations herein.”

Normally, an indemnity basket of either type will be subject to certain exceptions. The most common basket exceptions are for specified fundamental representations, standalone indemnities, and covenants.

Relationship of Baskets to Other Indemnification Limitations

An indemnity basket, whether deductible or tipping, is one of several different tools by which sellers seek to limit their indemnification obligations in M&A transactions, including the following:

Qualifiers

Use of qualifiers within the seller's representations and warranties, or other obligations, which are subject to indemnification will limit seller exposure. The more common of these qualifications relate to knowledge, materiality or material adverse effect, and dollar threshold levels.

Eligible Claim Thresholds or Mini Baskets

These provisions exclude from indemnification—and even application towards a basket—damages considered minor and insufficient to trigger an indemnification obligation. For example, an eligible claims threshold may exclude from indemnification, damages resulting from a claim or series of related claims which total less than $15,000 in amount.

Indemnity Caps

Typically, a seller's indemnity obligations will be capped in aggregate amount; these caps are often subject to exceptions, often the same as those applicable to baskets, as noted above.

Covered Damages

Sellers and buyers may agree to exclude certain types of damages from indemnity coverage, such as punitive or consequential damages.

The Parties’ Positions on Indemnity Baskets

A seller will usually argue in favor of an indemnity basket for the following reasons:

- Every operating business suffers claims and losses in the ordinary course. The buyer should not expect to acquire a perfect company but instead should be prepared to absorb some level of normal claims and liabilities.

- Indemnification, which often involves the seller taking control of the matter as the indemnifying party, can be time consuming for a seller seeking to extricate itself from the target's business after the transaction, and therefore only matters of a sufficient magnitude should trigger this process.

- Indemnity baskets are universally included in M&A purchase agreements.

A buyer may counter as follows:

- The scope of the seller's responsibility for target-related issues is appropriately reflected in the negotiated representations, warranties and covenants of the seller; limitations to that responsibility are created by the various negotiated qualifiers, including dollar thresholds, within the purchase agreement.

- Whether or not any given matter is of a magnitude appropriate for the seller's control through indemnity can be addressed by the parties at the time in good faith, without that contemporary discussion and decision being precluded by contractual terms.

Trends in Indemnity Baskets

Every other year since 2005 the ABA has released its Private Target Mergers and Acquisitions Deal Points Studies (the ABA studies). The ABA studies examine purchase agreements of publicly available transactions involving private companies. These transactions range in size but are generally considered as within the “middle market” for M&A transactions; the transaction values of the 123 deals within the 2021 study ranged from $30 to $750 million.

Over the nine ABA studies (2005-2021), the level of indemnity baskets as a percentage of transaction value, whether as mean or median, has remained fairly consistent.

For reference, the mean represents the average of all of the covered data, and the median represents the data point separating the lower and higher halves of the overall data, i.e., one-half of all data points are above and one-half are below the median. Median is often considered a more reliable indicator of what is normal or typical where data distribution is skewed.

As to the specific type of basket, deductibles have become increasingly common, now seen in almost ¾ of transactions reviewed in the 2021 study, as shown below.

GRAPHIC—Source: ABA Private Target Mergers and Acquisitions Deal Points Studies

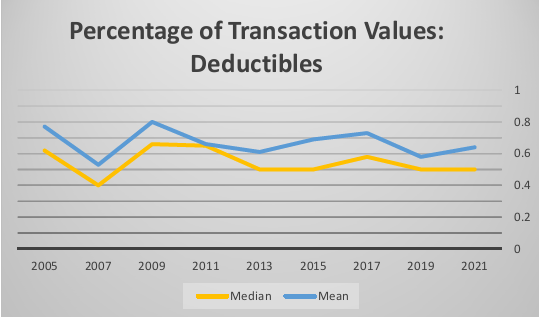

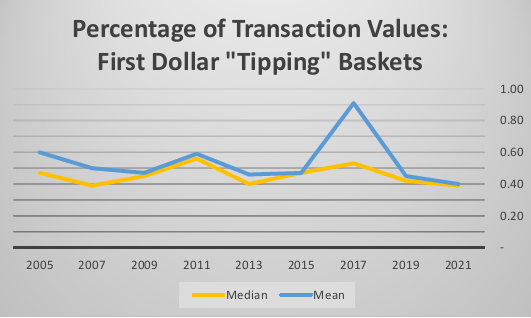

The following charts show how baskets have been set, within private company M&A agreements, as a percentage of transaction value.

GRAPHIC—Source: ABA Private Target Mergers and Acquisitions Deal Points Studies

GRAPHIC—Source: ABA Private Target Mergers and Acquisitions Deal Points Studies

GRAPHIC—Source: ABA Private Target Mergers and Acquisitions Deal Points Studies

The Role of Representation and Warranty Insurance (RWI) in Indemnity Baskets

One of the biggest changes in private company M&A during the past decade has been the enormous growth of representation and warranty insurance (RWI). With RWI, buyers and sellers are able to allocate some of the post-closing M&A indemnity risk to third party insurers. RWI has gone from being a differentiator that aggressive buyers offered to a much more common feature of private M&A deals. As indemnity risk has been shifted through RWI from sellers to third party insurers, avenues for a buyer's indemnity recourse against sellers have narrowed. This includes through the lowering of indemnity caps and even the elimination of post-closing seller indemnity for representations and warranties, subject to narrow exceptions, such as in the event of fraud.

The ABA Study in 2017 was the first to review the use of RWI in private M&A transactions, and to consider the relationship between indemnity caps and baskets and deals that referenced RWI in the transaction documents.

It is worth noting that relying on references to RWI in M&A transaction documents as evidence of RWI's usage is potentially imperfect. In the author's experience, sellers may insist that they have minimal involvement or connection with the RWI insurer or the RWI process, and that the buyer deal with indemnity risk wholly on its own, whether through RWI, self-insuring, or negotiations with the seller in the M&A documents. This approach is driven at least partly by the concern that if faced with claims, insurers may seek third party beneficiary, subrogation, privity or other means of recourse against the seller, notwithstanding language in the documents to the contrary, and the view that reducing any documentary connections with, or even references to, RWI could assist in a seller defense against such insurer claims.

In addition, where the seller, and not the buyer, is acquiring the RWI policy, one would expect there to be no need to reference the policy in the M&A documents, though those situations would likely not see an impact on seller indemnity caps or baskets. In other words, it is possible that some meaningful number of M&A deals with RWI have no references in the deal documents to the insurance policy itself.

The 2017, 2019, and 2021 ABA studies each show that indemnity caps were lower in reported deals where RWI was referenced in the deal documents, as compared with transactions without any such reference.

The linkage of indemnity baskets to RWI references seems consistent (i.e., baskets tend to be lower when RWI is present), though perhaps more tenuous than the connection between RWI and indemnity caps. The following charts show the relevant data with respect to RWI and indemnity baskets:

GRAPHIC—Source: ABA Private Target Mergers and Acquisitions Deal Points Studies

GRAPHIC—Source: ABA Private Target Mergers and Acquisitions Deal Points Studies

GRAPHIC—Source: ABA Private Target Mergers and Acquisitions Deal Points Studies

Conclusion

An indemnity basket, whether deductible or tipping, is one of several different tools by which a seller seeks to limit its indemnification obligations in M&A transactions. The indemnity basket is a true dollar matter for buyers and sellers— allocating financial responsibility for specified matters among buyer and seller, by dollar amount—and accordingly is an important component of an M&A purchase agreement. At the same time, the ABA studies show a consistency in practice as to indemnity baskets, and as such provide reliable benchmark data for parties seeking to implement customary or market approaches as to an indemnity basket.

Click here for a pdf of the article.

Reproduced with permission from Bloomberg Law. Copyright ©️2022 by The Bureau of National Affairs, Inc. (800-372-1033) http://www.bloomberglaw.com

/Passle/630ddfd8f636e917dcf6e4ce/MediaLibrary/Images/2024-04-10-02-23-24-827-6615f81c7f643c6b40a522fc.png)

/Passle/630ddfd8f636e917dcf6e4ce/SearchServiceImages/2024-03-26-18-33-10-871-660314e6a95774bc3ec2d0f5.jpg)

/Passle/630ddfd8f636e917dcf6e4ce/SearchServiceImages/2024-04-01-19-48-49-062-660b0fa164547688f7bc778e.jpg)

/Passle/630ddfd8f636e917dcf6e4ce/SearchServiceImages/2024-03-28-14-07-08-054-6605798c002b00c29f61ce55.jpg)