Goulston & Storrs M&A attorney Dan Avery is a nationally recognized expert on M&A deal point trends. In partnership with Bloomberg Law, Dan has developed a series of 25 articles looking at these trends, on a topic-by-topic basis, providing practical insight into where these trends are heading, and the relevant implications for M&A deal professionals.

Market Trends: What You Need to Know

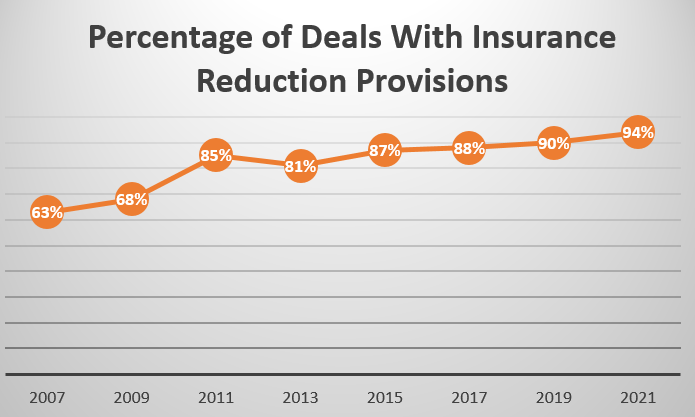

As shown in the American Bar Association’s Private Target Mergers and Acquisitions Deal Points Studies:

- Insurance reduction provisions were included in 94% of the merger and acquisition (M&A) deals reported in the 2021 study.

- Over the past 14 or so years covered by the eight ABA studies looking at the topic, the usage of insurance reduction provisions has increased from 63% to 94%—an increase of about 50%, and insurance reduction provisions have become a “given” in M&A purchase agreements.

Introduction

In M&A transactions, the definitive purchase agreement, whether it is an asset purchase agreement, stock purchase agreement, or merger agreement, typically contains representations, warranties, and covenants, along with related indemnification obligations. One common limitation to the parties’ indemnification obligations seeks to reduce the amount that the indemnified party may recover by the amount of any insurance proceeds that the indemnified party receives with respect to the matter giving rise to the indemnity claim, referred to herein as “insurance reduction provisions”. This article examines trends in the prevalence of insurance reduction provisions in private company M&A transactions.

Insurance Reduction Provisions Overview

The indemnification obligations under an M&A purchase agreement generally cover breaches of the representations, warranties, and covenants of the respective parties. However, the obligations may also extend to other matters on a standalone basis, regardless of whether such a breach has occurred. Examples of such extensions include seller indemnification for pre-closing taxes or for specific matters identified during legal due diligence.

Although a typical M&A agreement includes indemnification from seller to buyer and buyer to seller, the seller is typically the party who requests an insurance reduction provision. This is because the seller’s representations, warranties, and covenants, and related indemnification obligations are normally broader in scope and substance than those of the buyer, making the seller more likely to be the indemnifying party. Accordingly, this article examines insurance reduction provisions based on the assumption that the seller is more inclined, and the buyer less inclined, to include such a provision in an M&A agreement.

A typical M&A indemnification provision may read:

The Seller agrees to and will defend and indemnify the Buyer Parties and save and hold each of them harmless against, and pay on behalf of or reimburse such Buyer Parties for, any Losses which any such Buyer Party may suffer, sustain or become subject to, as a result of, relating to or arising from: (i) any breach by the Seller of any representation or warranty made by the Seller in this Agreement; (ii) any breach of any covenant or agreement by the Seller under this Agreement, (iii) any Taxes of the Seller or its Affiliates; or (iv) the matters set forth on Schedule X . . . .

The parties often negotiate various limitations to the indemnification obligations, including limitations relating to time and types of damages covered. Another category of indemnification limitations are referred to as “no windfall” limitations. No windfall limitations are designed to ensure that the party to which the indemnification is owed, the indemnitee, does not receive more from recovering on an indemnity claim than the indemnitee’s actual damages. The three most common no windfall limitations are:

- limitations that measure the indemnity coverage taking into account any tax benefit that the indemnitee realizes with respect to the underlying loss;

- limitations that prohibit multiple or parallel claims under different remedy sections of the purchase agreement with respect to the same matter; and

- insurance reduction provisions.

A normal insurance reduction provision may read:

The Seller will not have any liability under Section Y with respect to any Losses if and to the extent that any such Losses are reduced by any insurance or other third party payments received by the relevant Indemnitee(s).

Seller’s View on Insurance Reduction Provisions

The seller’s argument for including an insurance reduction provision typically focuses on fairness. For example, assume the buyer suffers losses of $100 regarding a matter that gives rise to a claim against the seller. The buyer submits a claim to its insurer for the losses suffered and the insurer pays the buyer $50 under the buyer’s policy. The seller would argue that, under that scenario, the buyer’s real damages are $50, not $100. Accordingly, to pay the buyer $100 would result in an unfair $50 windfall at the seller’s expense. And on that basis, a seller would argue, any indemnity obligations of the seller to the buyer should be net of, and be reduced by, the amount of insurance proceeds received, and only apply to the amount not covered by insurance but borne by the buyer.

Buyer’s View on Insurance Reduction Provisions

As a practical matter, insurance reduction provisions are quite common. Buyers routinely, though not always, accept the provision with relatively little resistance. Instead, buyers often negotiate for provisions stating that the buyer is not required to actually submit claims to an insurer or that state that any reduction should be tied to insurance proceeds actually paid, not just those available under a policy. Sometimes buyers agree to use commercially reasonable efforts to pursue insurance claims so long as any claims do not result in a premium increase for its insurance policies or otherwise negatively changes the insurability of the buyer’s activities, whether in terms of coverable risks or otherwise.

Another Argument?

A buyer may have credible arguments against the inclusion of insurance reduction provisions altogether, even if buyers rarely make such an argument. The crux of such an argument is why should the buyer’s own risk mitigation strategies be of any relevance to the scope of the seller’s indemnification obligation? For example, a buyer might argue that it is free to mitigate or insure against any particular risk as it sees fit, and the mitigation approach may be a combination of contractual indemnity from the seller and through insurance. As such, the buyer may decide to pay for insurance even if it has possible indemnification claims against the seller, so as to increase the number of potential parties against whom it may have recourse. Furthermore, the buyer has paid for the insurance itself and accepted the risk that the insurer may be unable or unwilling to pay claims.

Note in this regard that the buyer’s argument might be more persuasive if it purchased the insurance itself, as opposed to having acquired seller-purchased insurance through a stock acquisition. Nonetheless, the buyer might still assert that in the stock sale, it purchased the insurance because the buyer’s price for the transaction assumed that it would acquire the insurance without need to reduce claims of indemnification. In fairness, it’s highly unlikely that buyers actually take the insurance reduction concept into account in pricing a transaction, but there is some logic to the argument on its face, even if it is unlikely to carry the day.

In response, a seller could argue that the buyer’s decision to purchase business insurance is almost certainly based on a constellation of risks entirely independent of whether indemnification is available under the purchase agreement. Therefore, why should the seller be required to subsidize the buyer’s insurance purchasing decisions or provide a premium for the buyer’s decision to take the policy and insurance risk described above?

There are two potentially related concepts implicated with the buyer’s argument. Both are complex topics beyond the scope of the article, and, not surprisingly, not often the topic of heavy discussion during M&A negotiations. First, many states bar double recovery. However, the concept of double recovery generally applies to plaintiffs asserting insurance claims against multiple insurers for the same event, or different claims against the same defendant. By contrast, the collateral source rule, a well-established U.S. legal doctrine, generally prohibits a defendant from introducing evidence that the plaintiff has received amounts relating to the event at issue from another source, such as an insurance company.

Second, concepts of subrogation might also be relevant. Subrogation is defined by Merriam-Webster as “the assumption by a third party (as a second creditor or an insurance company) of another’s legal right to collect a debt or damages.” In the insurance context, this normally means that if an insurer pays its insured regarding an insured event, the insurer then steps into the shoes of the insured to pursue any rights of the insured against other third parties. Thus the issue here is whether an insurer, after payment of a claim to the buyer, would be able to pursue the related indemnity rights against the seller. The insurer’s right to subrogation may depend upon the wording of the insurance contract and relevant state law.

Trends in Insurance Reduction Provisions

Every other year since 2005 the ABA has released its Private Target Mergers and Acquisitions Deal Points Studies (ABA studies). The ABA studies examine purchase agreements of publicly available transactions involving private companies. These transactions range in size but are generally considered as within the “middle market” for M&A transactions; the transaction values of the 123 deals within the 2021 study ranged from $30 to $750 million.

Insurance reduction provisions were included in 94% of the deals reported in the 2019 study. Comparatively, the previous seven studies noted the inclusion of insurance reduction provisions in 90%, 88%, 87%, 81%, 85%, 68%, and 63% of reported deals, respectively. Thus, over the past 14 years, the usage of insurance reduction provisions has increased from 63% to 94%—an increase of about 50%, and as shown by the ABA studies, insurance reduction provisions have become a given in M&A purchase agreements. The chart below reflects this trend.

Conclusion

Insurance reduction provisions are increasingly and commonly included within M&A agreements, and are usually included with relatively little negotiation. Most of the negotiation relates not to whether limitation should be required, but rather whether it should be tied to insurance proceeds actually received, as opposed to simply being available, and whether the indemnitee should pursue recovery from its insurer before asserting an indemnity claim. Despite their inclusion becoming commonplace, there may be legitimate reasons, depending upon the overall dynamic of the transaction, for buyers to at least question whether an insurance reduction provision should be included in the M&A purchase agreement at all.

Click here for a pdf of the article.

Reproduced with permission from Bloomberg Law. Copyright ©️2022 by The Bureau of National Affairs, Inc. (800-372-1033) http://www.bloomberglaw.com

/Passle/630ddfd8f636e917dcf6e4ce/MediaLibrary/Images/2024-04-10-02-23-24-827-6615f81c7f643c6b40a522fc.png)

/Passle/630ddfd8f636e917dcf6e4ce/SearchServiceImages/2024-03-26-18-33-10-871-660314e6a95774bc3ec2d0f5.jpg)

/Passle/630ddfd8f636e917dcf6e4ce/SearchServiceImages/2024-04-01-19-48-49-062-660b0fa164547688f7bc778e.jpg)

/Passle/630ddfd8f636e917dcf6e4ce/SearchServiceImages/2024-03-28-14-07-08-054-6605798c002b00c29f61ce55.jpg)