Goulston & Storrs M&A attorney Dan Avery is a nationally recognized expert on M&A deal point trends. In partnership with Bloomberg Law, Dan has developed a series of 25 articles looking at these trends, on a topic-by-topic basis, providing practical insight into where these trends are heading, and the relevant implications for M&A deal professionals.

Market Trends: What You Need to Know

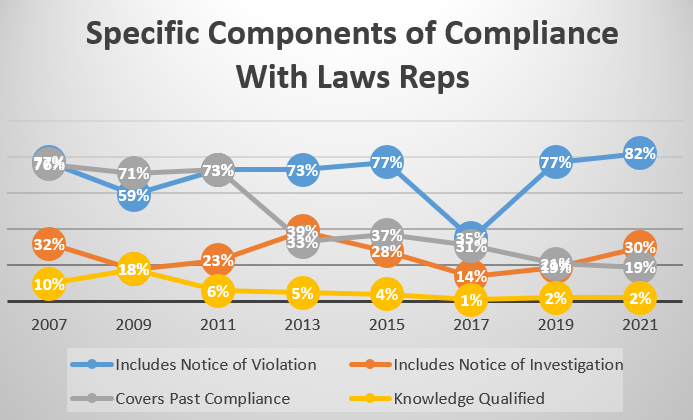

As shown in the American Bar Association’s Private Target Mergers and Acquisitions Deal Points Studies:

- Compliance with laws representations are almost always, barring highly unusual circumstances, present in merger and acquisition (M&A) purchase agreements; i.e., these representations are seen in 98%-100% of reported transactions. The negotiation between buyer and seller typically focuses on the scope of the representation, not whether to include the representation.

- The use of knowledge qualifiers for these representations continues to be rare, appearing in only 1% and 2% of reviewed transactions in the past three studies.

- The inclusion of past compliance in the representations has become, over time, the minority approach (reflecting a decrease in usage from 76% in the 2007 ABA study to 19% in the current, 2021 ABA study).

- Over the last eight ABA studies, inclusion of notices of investigations has been more the exception rather than the rule (seen in 30% of deals within the 2021 ABA study). In contrast, including notices of violations continues to be a common practice (ranging from 59% and the current high of 82% in the six studies between 2007 and 2021, with the exception of a one-study drop to 35% in 2017).

Introduction

In M&A transactions, the definitive purchase agreement (whether asset purchase agreement, stock purchase agreement, or merger agreement) typically contains representations, warranties, and covenants, along with related indemnification obligations. A common representation that the seller makes is that the target has operated its business in accordance with applicable laws (often referred to a “compliance with laws” representation). While sellers generally do not object to making a representation that addresses legal compliance, they usually seek to include certain limitations that narrow the representation’s scope.

Compliance With Laws Representations

A typical, though buyer-friendly, compliance with laws representation may read as follows:

The Company is in compliance, and since ______, 20__ has been in compliance, with all applicable laws, ordinances, codes, rules, requirements and regulations of foreign, federal, state and local governments and all agencies thereof relating to the operation of its business and the maintenance and operation of its properties and assets. No notices have been received by, and no claims have been filed against, the Company alleging a violation of any such laws, ordinances, codes, rules, requirements or regulations, and, to the knowledge of the Shareholders, the Company has not been subject to any adverse inspection, finding, investigation, penalty assessment, audit or other compliance or enforcement action. The Company has not made any bribes, kickback payments or other similar payments of cash or other consideration, including payments to customers or clients or employees of customers or clients for purposes of doing business with such Persons.

The compliance with laws representation is usually broad and does not focus on any specific aspect of non-compliance or any particular set of laws or regulations. Accordingly, it often covers the same ground as more topic-oriented representations which include legal compliance issues within a narrower context.

For example, seller representations regarding environmental issues, operating permits, labor and employment matters, and employee benefits typically include concepts of legal compliance within those areas (e.g., that the seller has complied with all environmental laws, etc.). To avoid confusion, the parties often include a clarifying statement within the compliance with law representation stating that the representation does not address the specific legal compliance areas within the more focused representations. This is particularly true if the compliance with laws representation is treated differently for indemnity purposes, whether in terms of its survival period and/or caps and baskets, than the more topic-focused representations.

Negotiation of the compliance with laws representation, and related seller disclosures, can often help a buyer in its diligence of the target. Rushna Heneghan, deputy general counsel at Charles River Laboratories, said, when “we are looking at an acquisition target, the compliance with laws rep serves two purposes. It allocates responsibility as between buyer and seller for compliance issues, but it will also, hopefully, prompt a seller to raise any such issues or concerns during the disclosure process.”

This is helpful because the buyer can then consider the disclosed information in assessing the overall risk profile of the target. “While the rep itself is important, I’d much rather know the underlying compliance problems than close the transaction with a strong indemnity claim for breach of the rep,” Heneghan said.

Buyer and Seller Approaches

As reflected below, compliance with laws representations are seen in virtually every M&A deal. So, unlike many other components in an M&A purchase agreement, sellers generally do not argue against including such a representation. Instead, the negotiation between buyer and seller tends to focus on potential limitations to the representation, most notably along the following lines:

- Knowledge Qualifiers. Should the representation be qualified by the “knowledge” of one or more seller-related individuals?

- Past and Present Compliance. Should the representation cover past as well as present compliance? If so, should past compliance be limited by time (e.g., compliance during the past X years)?

- Notices of Investigations. Should “compliance with laws” extend to notices of investigations by government entities or similar parties?

- Notices of Violations. Similarly, should “compliance with laws” extend to notices of violations?

Trends in Compliance With Laws Reps

Every other year since 2005 the ABA has released its Private Target Mergers and Acquisitions Deal Points Studies. The ABA studies examine purchase agreements of publicly available transactions involving private companies. These transactions range in size but are generally considered as within the “middle market” for M&A transactions; the transaction values of the 123 deals within the 2021 study ranged from $30 to $750 million.

According to the ABA studies, compliance with laws representations were included in all or almost all (98% to 100%) of the transactions reviewed over the past eight ABA studies. (The first ABA study in 2005 did not look at compliance with laws representations.) In addition, as reflected in the ABA studies:

- Including a knowledge qualifier to a compliance with laws representation has become increasingly rare over the past 14 years (now, almost never seen).

- The representation sometimes addresses past compliance as well as present compliance (though this has dropped off in prevalence in the past five ABA studies). It is unclear what may have caused a considerable drop-off in past compliance coverage by the compliance with laws representation in the 2013, 2015, 2017, 2019 and 2021 studies, particularly in light of the stability or at least “smooth trending” of the other compliance with laws issues over the eight ABA studies that examined the representation. That only approximately one-fifth to one-third of compliance with laws representations covered past compliance in the five most recent ABA studies is not consistent with the author’s experience.

- More often than not the representation does not expressly cover notices of investigations but usually does cover notices of violations (though there was a sharp drop-off with respect to notices of violations in the 2017 ABA study, which has since rebounded to a more historically consistent level).

The following graph shows these trends with more specificity.

Conclusion

Compliance with laws representations are almost always, barring highly unusual circumstances, present in M&A purchase agreements; i.e., these representations are seen in 98%-100% of reported transactions. The negotiation between buyer and seller typically focuses on the scope of the representation, not whether to include the representation.

The use of knowledge qualifiers for these representations continues to be rare, appearing in only 1% and 2% of reviewed transactions in the past three studies. The inclusion of past compliance in the representations has become, over time, the minority approach (reflecting a decrease in usage from 76% in the 2007 ABA study to 19% in the current, 2021 ABA study. Additionally, over the last eight ABA studies, inclusion of notices of investigations has been more the exception rather than the rule (seen in 30% of deals within the 2021 ABA study). In contrast, including notices of violations continues to be a common practice (ranging from 59% and the current high of 82% in the six studies between 2007 and 2021, with the exception of a one-study drop to 35% in 2017).

The compliance with laws representation is likely to continue to be one of the less controversial components of an M&A negotiation, but there still remain potential scope limitations to be worked out between buyer and seller, which can shift underlying risk in one direction or the other.

Click here for a pdf of the article.

Reproduced with permission from Bloomberg Law. Copyright ©️2022 by The Bureau of National Affairs, Inc. (800-372-1033) http://www.bloomberglaw.com

/Passle/630ddfd8f636e917dcf6e4ce/SearchServiceImages/2024-04-22-16-48-04-221-662694c48171a252db3820bd.jpg)

/Passle/630ddfd8f636e917dcf6e4ce/SearchServiceImages/2024-04-22-15-12-36-997-66267e64d100dba38ac045e7.jpg)

/Passle/630ddfd8f636e917dcf6e4ce/MediaLibrary/Images/2024-04-22-13-15-13-552-662662e18171a252db378c86.png)

/Passle/630ddfd8f636e917dcf6e4ce/MediaLibrary/Images/2024-04-10-02-23-24-827-6615f81c7f643c6b40a522fc.png)